Deciding between leasing vs financing a car in Bangladesh is a crucial step for many new buyers. Whether you're a student, a young professional, or a growing entrepreneur, selecting the right car ownership model will impact your finances, flexibility, and future vehicle choices. This article breaks down the pros and cons of both leasing and financing so you can make a smart, informed decision.

What is Leasing and Financing?

Leasing

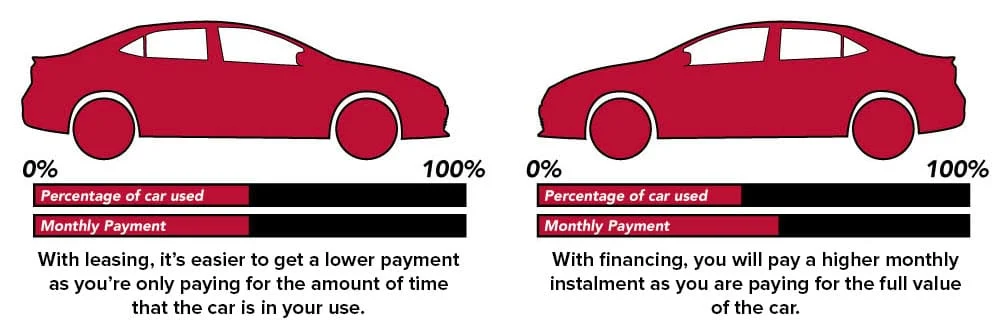

Leasing allows you to use a car for a fixed term (typically 2–4 years) by paying monthly installments based on depreciation and interest. At the end of the lease, you return the vehicle or buy it at the predetermined residual value. Leasing offers lower monthly payments and usually includes warranty coverage throughout the term.

Financing

Financing involves taking a loan to purchase a vehicle. You pay monthly installments until the full amount, including interest, is paid off. Once complete, the car is yours. Financing may require a higher upfront payment, but it provides ownership and long-term flexibility.

Pros and Cons of Leasing vs Financing a Car in Bangladesh

Advantages of Leasing

-

Lower monthly payments

-

Minimal maintenance due to new car warranties

-

Ability to drive a newer model every few years

-

No long-term commitment

Drawbacks of Leasing

-

No ownership or equity

-

Annual mileage restrictions

-

Penalties for wear and tear

-

You must return the car or pay the residual to own it

Advantages of Financing

-

Full ownership after loan repayment

-

No mileage restrictions

-

Resale value stays with you

-

You can modify or customize the vehicle freely

Drawbacks of Financing

-

Higher monthly payments

-

Long-term maintenance costs

-

Car depreciates over time

-

Requires a strong financial plan

When to Choose Each Option

Leasing is Ideal If:

-

You want lower monthly payments

-

You drive mainly in urban areas like Dhaka

-

You like upgrading cars every few years

-

You want fewer maintenance concerns

Financing is Ideal If:

-

You plan to keep your car long-term

-

You travel frequently and need unlimited mileage

-

You want to build equity in an asset

-

You may want to sell or customize the vehicle later

Where to Find the Right Deal

To explore trusted lease and finance deals in Bangladesh, visit GarirBazar. The platform lists verified vehicles and helps compare car loan offers and lease agreements tailored to your needs.

Conclusion

Choosing between leasing vs financing a car in Bangladesh depends on your lifestyle, driving habits, and financial goals. Leasing offers short-term convenience and lower costs, while financing provides ownership and long-term value. Assess your priorities to make the right move.

Which option fits your needs better—leasing or financing? Drop your opinion in the comments and join the discussion!